Imagine being able to make informed decisions based on sound mathematical principles rather than blind intuition or guesswork. The Kelly Criterion does exactly that by taking into account both the expected value of bets and the size of one's bankroll to determine optimal wagering amounts. In this article, we'll delve into the inner workings of Kelly Criterion gambling, exploring its core principles, practical applications, and potential pitfalls. Whether you're a seasoned gambler looking to up your game or simply intrigued by the intersection of math and gambling, understanding what Kelly Criterion betting is all about may just be your ticket to smarter, more strategic wagering.

This revolutionary betting strategy, developed by John L. Kelly Jr. in 1956, has been a game-changer for professional gamblers and investors alike. By harnessing the power of mathematics and probability, the Kelly Criterion offers a systematic approach to maximizing returns while minimizing risk in any form of speculative investment, including sports betting, stock trading, and casino games.

Who was John L. Kelly and how did he develop the Kelly Criterion?

John L. Kelly Jr. was a brilliant scientist and mathematician who worked at Bell Labs in the 1950s. While there, he developed the groundbreaking Kelly Criterion, which revolutionized the field of probability and investing. The Kelly Criterion is a formula used to determine the optimal size of a series of bets or investments in order to maximize long-term growth.

Kelly's work centered around information theory and game theory, leading him to develop this formula as a way to manage risk and achieve maximum returns in gambling and investing scenarios. His insights into probability and decision-making have had lasting impacts across diverse fields, from finance to artificial intelligence. By considering not just the potential returns on an investment but also its probability of success, Kelly shifted the focus from blind risk-taking to strategic, mathematically informed decision making, leaving behind an enduring legacy that continues to shape modern investment strategies.

How do sports gamblers use the Kelly Criterion to determine their bet sizes?

Sports gamblers often rely on the Kelly Criterion to determine their bet sizes, as it provides a mathematical formula for calculating the optimal amount to wager. By taking into account the gambler's edge and the odds offered by the sportsbook, the Kelly Criterion helps bettors make informed decisions about how much money to put on a particular outcome. This approach allows for maximizing potential returns while minimizing risk, making it an attractive strategy for many seasoned gamblers.

One of the key insights of using the Kelly Criterion is its focus on long-term profitability rather than short-term gains. By carefully calculating and managing their bet sizes based on their edge and odds, sports gamblers can aim for consistent, sustainable growth in their bankroll over time. This method emphasizes disciplined betting and risk management, helping to avoid reckless behavior that can lead to substantial losses. Ultimately, leveraging the Kelly Criterion enables sports gamblers to approach their wagers with a strategic mindset aimed at optimizing profits in a calculated manner.

In addition, some experienced sports gamblers may combine elements of subjective judgment with objective calculations when applying the Kelly Criterion. While this mathematical model provides valuable guidance on bet sizing, it doesn't take into account other factors such as situational analysis or market sentiment. Thus, bettors often find success by incorporating their own expertise and intuition alongside the Kelly Criterion's recommendations when making betting decisions.

What is the Kelly Criterion Formula?

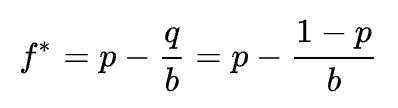

In cases where the loss of the bet results in forfeiting the entire stake, the Kelly Criterion betting formula is:

- f* is the fraction of the current bankroll to wager.

- p is the probability of a win.

- q is the probability of a loss (q = 1 - p)

- b is the proportion of the bet gained with a win. Example: if you're betting $100 getting 3-1 odds, a win would earn you a profit of $300. In this case, b = $300 / $100 = 3.0.

Here is a full example of how to use the Kelly Criterion betting formula. A bet has a 55% chance of winning (p = 0.55, q = 0.45) and you're receiving -110 odds (b = 0.91). According to the Kelly Criterion formula, in order to maximize your expected earnings you should bet 5.5% of your bankroll on this game (f* = 0.55 - (0.55 / .91) = 0.055).

If no edge is available, meaning b = q/p, then the Kelly Criterion recommends no placing a bet.

What are the dangers of using the Kelly Criterion sports betting formula?

The Kelly Criterion sports betting formula has been widely utilized by bettors as a tool to manage their bankroll and optimize their bets. However, the inherent danger of this strategy lies in its aggressive approach to wager sizing. The formula recommends placing a significant percentage of one's bankroll on each bet, which can result in considerable financial loss if the bets do not pan out as expected.

Moreover, the Kelly Criterion does not take into account the unpredictability of sports events and outcomes. It relies solely on historical data and probabilities without considering external factors such as injuries, weather conditions, or psychological factors that can significantly influence the outcome of a game. Therefore, blindly following the Kelly Criterion without comprehensive analysis and judgment can lead to reckless betting behavior and substantial financial risks.

In addition, using the Kelly Criterion may lead to emotional stress and impulsivity in decision-making when facing losing streaks. Bettors might feel compelled to increase their bet sizes in an attempt to recover losses quickly according to the formula's recommendations, further exacerbating their potential for financial ruin.

How do sports gamblers modify the Kelly Criterion formula to reduce risk?

Sports gamblers often modify the Kelly Criterion formula to reduce risk by implementing a fractional Kelly strategy. This approach involves betting a fraction of the recommended Kelly bet size, which helps to mitigate the impact of potential losses. By scaling down their wagers, gamblers can protect their bankroll during periods of uncertainty or when facing higher-risk bets.

Additionally, some sports gamblers opt to incorporate other risk management techniques alongside the Kelly Criterion, such as using stop-loss limits or setting maximum bet sizes. These measures help to create a more conservative approach to bankroll management and can prevent significant losses during unfavorable betting conditions. By adjusting and customizing the Kelly Criterion formula to match their risk tolerance and overall betting strategy, sports gamblers can optimize their chances for long-term success in the unpredictable world of sports betting.

Is there any proof of the Kelly Criterion returning positive gains for sports bettors?

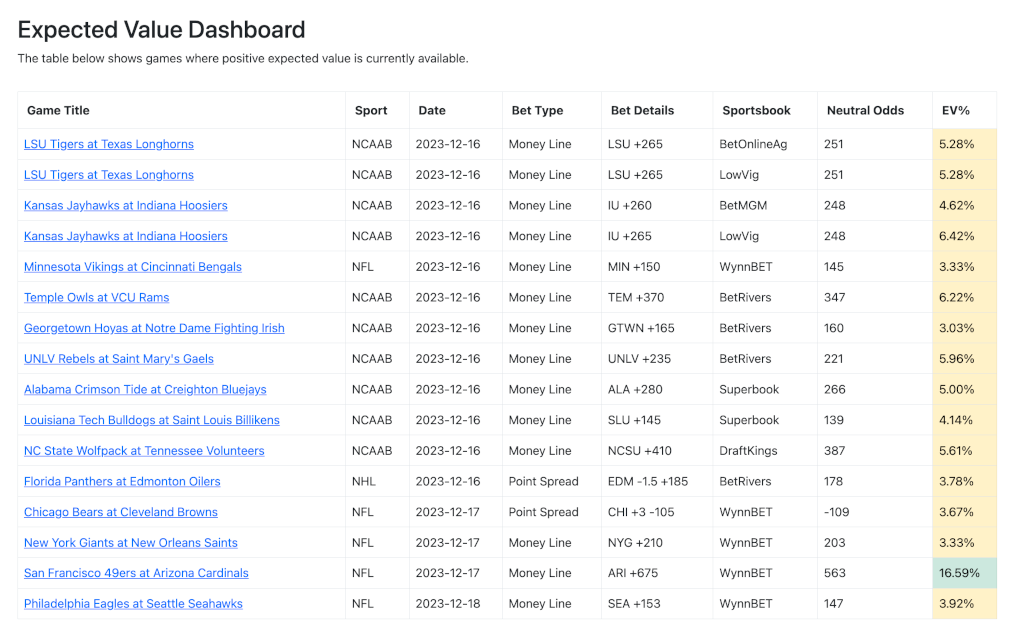

In a Spring 2023 document, the Sports Analytics Student Research Journal at Wharton University delved into the topic of An Investigation of Sports Betting Selection and Sizing. The study revealed that savvy sports bettors can leverage average implied odds to gauge real probabilities and pinpoint undervalued lines, leading to potentially profitable opportunities. Furthermore, the research delved into different methods for applying variations of the Kelly Criterion to calculate appropriate bet sizes when such profitable opportunities arise.

Prior to considering bet sizes, it was necessary to pinpoint the positive expected value bets. Their approach to selecting bets was founded on a standard vig of 10% juice, or the implied probabilities adding up to 110 instead of the typical fair 100 in the industry. Consequently, each betting line should encompass approximately 3.3% juice. They utilized an average of lines from numerous sportsbooks to establish true fair odds (including the vig), and subsequently compared this average with lines offered by individual sportsbooks to identify opportunities for expected value.

After establishing this betting selection framework, they simulated the outcomes of various betting size tactics such as: constant sizing, Full Kelly, Partial Kelly, and different expected value margin thresholds. The constant bet sizing tactic served as a standard against which bets with an expected value of 5% or higher were chosen and each received a $50 stake. This approach proved highly effective, generating a $10,000 gain when implemented across 10,275 wagers out of a total of 121,507 games played over multiple years.

Testing with the Full Kelly Criterion

The initial experiment with a strategic bet sizing approach involved utilizing Full Kelly, which aims to maximize the expected logarithm of returns. Despite the potential for impressive results, applying the Full Kelly Criterion to their specific data set exposed fatal flaws. One particular bet appeared highly advantageous, leading Kelly to recommend a 90% allocation of the bankroll. However, an unexpected streak of bad luck and an extremely unlikely loss resulted in complete devastation. Even after imposing a maximum cap of 20% of the bankroll for Kelly sizing, the $10,000 bankroll ultimately dwindled to nothing due to Full Kelly's overly aggressive nature. Repeated occurrences of this nature demonstrated that this approach is not practical for bettors with finite bankrolls that cannot be easily replenished in real-world scenarios.

Testing with the Partial Kelly Criterion

One popular way to modify the Kelly criterion is by implementing Partial Kelly, which aims to decrease variability by reducing the size of bets. This approach is widely utilized by both gamblers and investors because the original Kelly criterion is often too aggressive for sustainable bankroll management in most cases. The partial Kelly strategy accounts for the uncertainty of the underlying probability, which is always present in sports betting. As expected, this led to better results for their algorithm, although certain coefficients performed better than others. Even though Half Kelly still led to eventual loss in every simulation, it did occur later than with Full Kelly.

Testing with the Quarter Kelly Criterion

In one quarter, Kelly demonstrated significantly improved outcomes, generating a $40,374 profit from 10,275 bets. By steadily decreasing the coefficient, the profits accelerated at an increasing rate. Partial Kelly is effective due to its consideration of the potential for errors by oddsmakers. It acknowledges that just because oddsmakers appear to have reached a consensus on an event does not guarantee full confidence in the underlying probability. A Full Kelly bettor who unquestioningly believes this will undoubtedly face ruin when an inevitable losing streak wipes out their bankroll.

Experimenting with different Expected Value thresholds

Apart from using different betting strategies, they also tried out changing the expected value threshold criterion for their bet selections. Previously, they worked with a 0.05 margin, which meant that the best odds had to be five percentage points better than the average odds for them to place a bet on the market. To investigate the effect of margin size, they tested each strategy with a more conservative 10% margin and a more aggressive 2.5% margin. The results were significant; they made 79,860 bets with a 2.5% EV margin, which decreased to 10,275 bets with a 5% EV margin, and ultimately dropped to only 369 bets when using a 10% EV margin.

The conservative approach yielded the highest returns. Despite the low number of bets, the $50 fixed bets generated a lower total profit, which was not unexpected. On the other hand, the results for Kelly betting were significantly better. Employing a Full Kelly strategy prevented them from going bankrupt and resulted in a loss of only $1,549. Meanwhile, Half Kelly proved to be remarkably profitable with a $115,097 profit! Quarter Kelly also remained profitable with a return of $62,425. In contrast, the aggressive approach using only 2.5% EV margin led to extreme outcomes: $50 fixed bets led to bankruptcy, and all Kelly strategies resulted in financial ruin as well.

Predictably, employing a conservative betting strategy yields the highest profits, albeit with a significantly smaller betting pool. Conversely, opting for higher margins of 5% and 2.5% results in a larger pool but carries the risk of reduced returns, as evidenced by their underwhelming performance in those scenarios. A recurring theme in these simulations is the correlation between safety margins and confidence in placing bets, allowing for a more aggressive Kelly strategy to maximize profits. This explains why Half Kelly is most lucrative with a 10% EV margin, while Quarter Kelly outperforms with a 5% EV margin. Their analysis underscores the perils of using Full Kelly across all thresholds, as losses were incurred in all three scenarios. It emphasizes the importance of adhering to stricter margins and prioritizing high-quality bets over quantity by increasing betting volume.

Conclusions of this study

In their simulated betting environment, the Full Kelly strategy proved to be ineffective, resulting in bankruptcy in 100 out of 100 scenarios. This outcome is widely known in the sports betting world and has been confirmed by data analysis. In a low-margin setting, using a constant bet size strategy is not profitable. Their research provided strong evidence that not only do bookmakers' margins make the odds unfair for bettors, but they also make it practically impossible to turn a profit. Employing an aggressive bet selection criteria like the 2.5% EV threshold and repeatedly placing $50 bets will lead to significant losses. On the other hand, a conservative margin can be highly profitable in theory. For example, with their 10% EV threshold, they generated a profit of $2,934 after placing $18,450 in total bets, representing approximately a 16% return on investment.

They discovered that employing a conservative 10% EV threshold and a 0.50 coefficient for Partial Kelly is the most lucrative strategy. This approach effectively reduces variance, prevents excessively large bets that could lead to bankruptcy, and steers clear of games with high bookmaker margins. By exclusively betting on precise matches within their dataset, one could expect to achieve an annual return of approximately 80% over an 11-year period!

Kelly Criterion Summary

In conclusion, the Kelly Criterion has long been established as a valuable tool for determining optimal bet sizes. However, recent studies have shown that modifying the formula to half or quarter Kelly will yield better results when combined with conservative expected value bet selections. This approach reduces the risk associated with aggressive betting strategies while still allowing for profitable outcomes. By incorporating these adjustments into their betting systems, individuals may be able to maximize their returns and minimize potential losses. It is clear that taking a more cautious approach to bet sizing, in conjunction with sound selection methods, leads to improved long-term profitability in the realm of gambling and investment. Consider applying these findings to your own betting strategy for a more prudent and effective approach.